The High Cost of Poor CX: Why Customer Experience Risk Is Business Risk

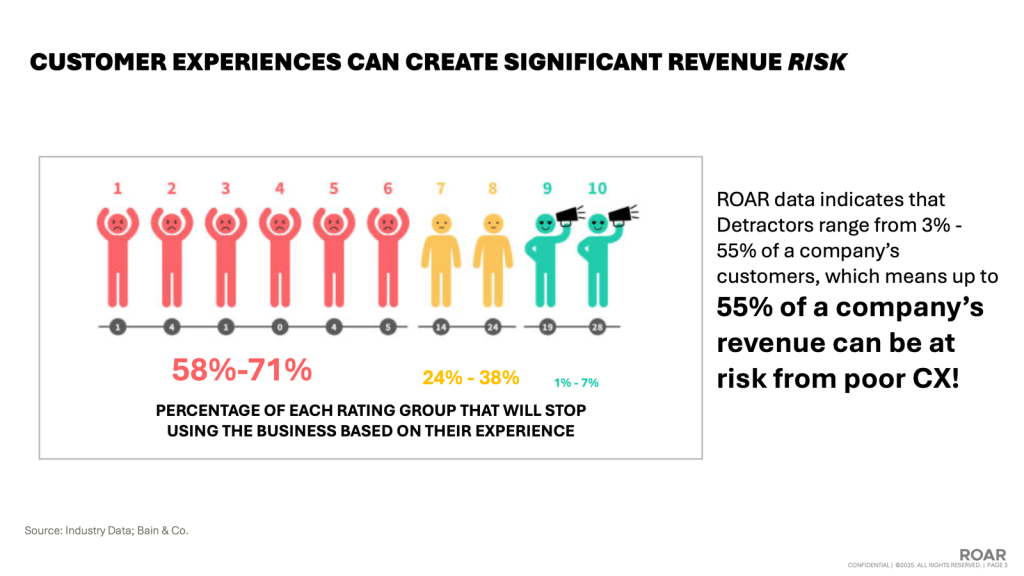

Customer experience (CX) is not just about satisfaction — poor CX can put up to 55% of revenue at risk, as detractors are far more likely to leave. Lost acquisition, retention, and advocacy compound over time, making CX failures more costly than marketing or pricing pressures. ROAR’s CX Platform identifies risk in real time, quantifies revenue impact, and helps recover sales through targeted improvements. By treating CX as a core risk management discipline, companies can protect revenue, strengthen loyalty, and turn risk into resilience.

- When Experience Becomes Exposure Customer experience (CX)

- The Double Hit

- Seeing Risk Before It Hurts

- Turning Risk into Resilience

- Takeaway

When Experience Becomes Exposure Customer experience (CX) isn’t a soft metric — it’s a financial one. The data behind ROAR’s CX Risk Analysis makes that clear:

Up to 55% of a company’s revenue can be at risk from poor customer experiences.

Using global industry data and ROAR’s analytics, we see that “detractor” customers — those rating their experience between 1 and 6 — are not just less satisfied; they are far more likely to stop doing business altogether. According to Bain & Co. research, 58%–71% of low-rating customers will leave, compared to only 1%–7% of promoters who rate their experience a 9 or 10.

That’s the revenue cliff hidden in plain sight.

The Double Hit

Losing Today’s and Tomorrow’s Customers CX risk doesn’t just affect this quarter’s sales. It compounds over time, eroding both potential customers and long-term customer value.

- Lost acquisition — Shoppers who experience poor lead handling or confusing online journeys rarely return. Every missed follow-up or delayed response quietly increases customer churn before a sale even begins.

- Lost retention — Current customers who feel undervalued, inconvenienced, or misled after purchase don’t just stop buying; they stop recommending. The lifetime value of that lost trust is often 10x the cost of the initial sale.

- Lost advocacy — In today’s transparent digital environment, detractors don’t leave quietly. Their online reviews and social commentary directly reduce future consideration for your brand or dealership.

Add it up, and the total profit impact of poor CX can exceed marketing budgets, operational cost inefficiencies, and price pressures combined.

Seeing Risk Before It Hurts

Most businesses only see the financial impact of CX failures after the loss has already occurred. ROAR’s mission is to make that risk visible — before it hits the bottom line.

Our CX Platform and subscription products continuously monitor and quantify CX risk, identifying where dissatisfaction is forming and why. We analyze signals across the customer journey — from online inquiry and showroom interaction to service and ownership, including customer support — to spotlight where revenue is being lost and where improvement will pay off fastest.

ROAR’s CX subscriptions don’t just measure satisfaction; they measure revenue risk exposure — and help teams reduce this risk.

Turning Risk into Resilience

By integrating survey data, reputation intelligence, and behavioral analytics, ROAR transforms CX into a measurable business discipline. Our platform enables dealerships, workshops, and brands to:

- Detect CX risk in real time.

- Quantify its potential revenue and profit impact.

- Implement targeted actions to retain customers and recover sales.

- Track the ROI of CX improvements over time.

This approach empowers leaders to treat CX the same way they treat safety, compliance, or financial control — as an essential element of risk management.

Takeaway

Poor customer experience isn’t just bad optics — it’s a financial vulnerability that can quietly drain up to half of a company’s revenue potential. By identifying and reducing CX-related risk, businesses don’t just protect satisfaction; they protect their future.

With ROAR’s CX Platform and CX Risk Subscriptions, companies can finally see where experience risk lives, understand its cost, and act decisively to stop the loss before it happens.

Because the real bottom line is simple:

When customers leave, revenue follows. When experience improves, profit returns.r attitudes toward your business longer into the ownership experience.